Risk Management in Private Practice - How to Reduce the likelihood of a Claim

Reducing medical negligence claims through the use of risk management strategy

Blog

September 17, 2019

Risk Management - How does it reduce the likelihood of a claim?

Did you know that even if the procedure or advice you or your staff performed/provided was conducted perfectly, that if a patient feels the treatment or advice had adverse effects on them, they are likely to file a claim against you or your place of practice.Medical Indemnity insurance is a professional legal requirement for healthcare practitioners. It is designed to protect you from financial and reputational loss, in the event of a claim. A single, subjective decision can often lead to life changing moments for healthcare practitioners where claims get dragged on for years, resulting in expensive litigation and loss of income for the practitioner until the claim is ongoing. There are however, many other ways you can reduce risk exposure, and therefore mitigating the chances of a claim occurring.An example of this would be implementing a ‘risk management strategy’ into your work ethic and working environment. This is “a plan, or strategy, designed to limit the number of medical mistakes that occur” according to the ECRI Institute.

Considering Risks in Private Practice

In order to manage your risks, you must first identify them. One private practice’s risk is different from the next. They vary due to a mixture of different factors such as working environment, code of conduct, staff members and the details of the medical service you are providing. Likewise your risk management plan may be different from someone else’s.When risk assessing it can be hard to see what claims may occur. We always recommend that when looking for problems to solve you should consider the following:

Analysing Your Medical Risk Exposures

Once you have identified any potential risks, you have the opportunity to reduce them drastically. Ask yourself questions when you consider each risk.How likely is this risk to occur?How serious would the effects be?Who would suffer most from this risk?Can anything be done to manage this?Is this risk preventable?If this risk is unavoidable, is there anything you can do after the risk occurs to reduce any negative effects on the patient?By assessing these challenges, you can easily come up with solutions you may not have thought of otherwise, reducing the severity of any risk aftereffects. From these questions you should also be able to see which problems are the worst and therefore prioritise the bigger risks when problem solving.

Ways to Reduce Challenges in Private Practice

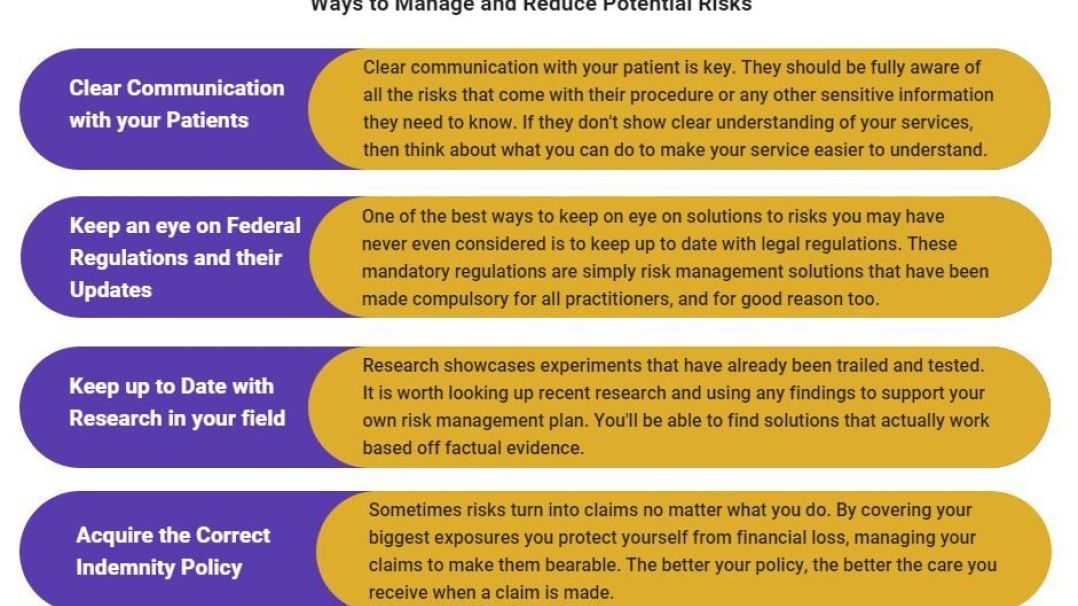

Once you have analysed your risks, you can then implement ideas and actively start to reduce the chance of a claim being made. Here are a select few actions you can make to take your risk into your own hands:

Once your risk management plan is in place you and your team must remain proactive in order to manage your strategy. Sometimes, a solution that works for one practice, might not work for yours. If the solution you have decided to implement is unsuccessful, analyse why it was unsuccessful, and use that data to improve your plan for the next time. Select an individual to manage and monitor your strategy. By keeping in touch with your plan and its physical affects you can edit it to become far more superior.

If I Risk Manage effectively, do I still need Indemnity / Medical Malpractice Insurance?

Yes. It must be stressed that while risk management is extremely important, it is not an alternative to medical indemnity / medical malpractice, as it is a lawful requirement in order to legally practice in the UK.Indemnity Insurance is required to help protect you in the event your risk management plan was unsuccessful. Therefore, if a claim is filed, you are not devastated with any related financial costs after purchasing your indemnity policy.By having a good balance of the two, you can ensure a far higher level of protection and care against a patient who feels they have been severely misinformed or mistreated.As an award-winning specialist healthcare insurance intermediary and risk manager, you can learn more about our Medical Indemnity policies and our union-style product, ServCare – along with the different products we offer for private medical practices here, and individual medical practitioners here.