'Coronavirus will cost Insurers more than $200 Billion' reports Lloyd's of London

Coronavirus costs insurers $203 Billion USD in claim costs and investment losses

Insight

May 14, 2020

The Lloyd's of London Report - Coronavirus' Impact

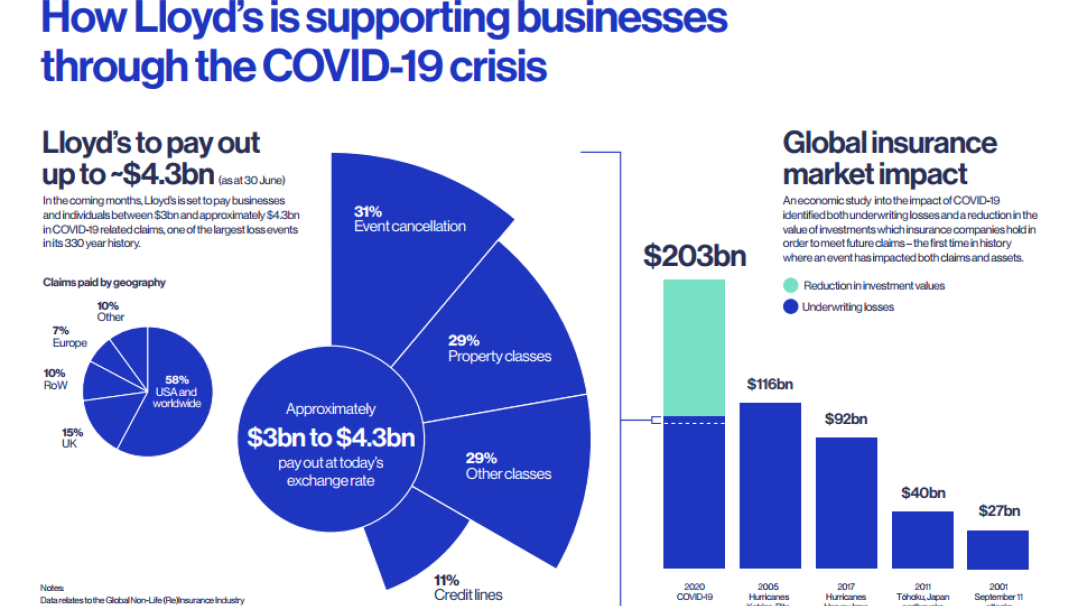

According to a recent forecast report via Lloyd’s of London, it has been said that the “coronavirus pandemic will cost the insurance industry over $200 Billion USD”.Of the total estimated figure at $203 Billion USD, half of the losses related to claims made against insurers for event cancellations, business interruption and trade credit cover.Another $96 Billion USD comes from investment losses where the financial market has begun to his Insurer’s assets used to hold fund claims.

“This is a loss of a magnitude that none of us have seen in our lifetime,” said John Neal (Lloyd’s of London Chief Executive).

This estimated figure of $203 Billion USD is the first estimated figure to take into account the full economic impact of COVID-19 on the Insurance Industry General Insurance Products (‘Property’ and ‘Casualty’ Insurance).This marks 2020 as one of the most expensive financial losses in years since 2017 and 2005, where insurers faced huge pay-outs following a series of dangerous storms in the US and Caribbean, and 2001, where the 9/11 terrorist attack generated a large number of claims.What makes the coronavirus situation different however, is the wide spread global impact of the crisis.

“I don’t think anybody envisaged a scenario where each customer was sustaining the same loss at the same time everywhere in the world,” said John Neal.

Based on estimations provided via the London Market’s Insurers, Lloyd’s Market will be expected to pay out claims at a total of around $3 to $4.5 Billion USD. This is assuming the UK lock-down ends between May and June.If UK lock-down is extended to after June there is a possibility of these figures increasing. Does the industry have the capacity to cope with this? Mr Neal has said the industry has enough in reserve to pay off its claims; however, around half of the insurers at Lloyd’s of London will have to raise the fresh capital following these losses.The reported figures released by these insurers, show the total figure currently set aside to pay for claims in relation to the crisis has exceeded $3.3 Billion USD.Mr Neal has said that after paying off any claim pay-outs and suffering the brunt of investment losses, there is expected to be an added impact on premiums.

“A loss of the magnitude of $200 Billion USD will have an inevitable impact on price. You have to assume over time that prices will rise. As we go into recession, there is a clear impact. Recession means less activity, which means less... volume.”

It is also believed that once a final conclusion is made on COVID-19's social and economic impacts, the final costs value (affecting specifically the global 'non-life' insurance) will exceed previous historical records.

Looking to the future - How Lloyd's is supporting businesses

Looking to the future in a more hopeful manner, Lloyd’s of London has set aside £15 Million GBP to explore different options available for cover to be provided for future big crises.Additionally, part of the £15 Million GBP is being used to insure more than 20 clinical trials of treatments for COVID-19.New policies are being drawn up by some of Lloyd's finest minds and providers to "support the immediate health response as well as the longer-term exit strategy", including searches for diagnostics, treatments and vaccinations. One of Lloyd's of London's syndicates has insured over 100 individual clinical trials across the global conducting medical experiments assessing the various stages and physical impacts of COVID-19. Lloyd's of London have also said they will be making various announcements in the future regarding short term, mid term and long term strategies in the fight against the effects of COVID-19. According to an official announcement made via Lloyd's themselves, one initiative Lloyd's has been working on involves creating a "Recover Re" insurance vehicle. This will offer "after the event" coverage for "pandemic related business recovery", including the current coronavirus pandemic.